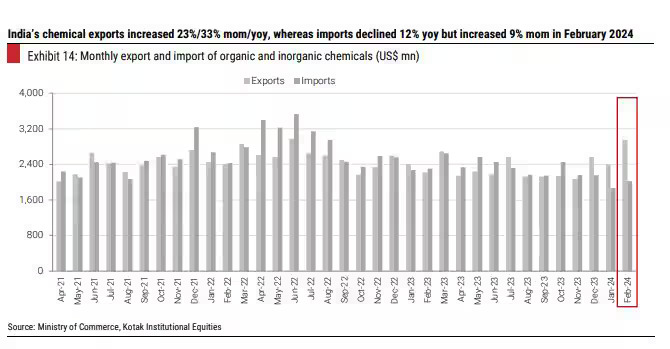

Surprise Jump of 33% YoY in Indian chemical exports, reasons not apparent: Kotak Institutional

The brokerage's analysts noted that imports fell 12 percent YoY.

There is a surprising jump in India's chemical exports and the reasons for this are not immediately apparent, noted analysts at Kotak Institutional Equities.

The exports increased 33 percent year-on-year (YoY) in February and 23 percent month-on-month (MoM). Imports meanwhile fell 12 percent YoY and rose 9 percent MoM.

Significant ramp up in capacities to help achieve $40 billion exports target.

In their report on the sector, the analysts wrote, India’s exports of organic and inorganic chemicals jumped 23%/33% MoM/YoY in February 2024 for reasons that are not yet apparent — the leading specialty chemical companies do not seem to have experienced a pickup.

They added, "The demand environment generally remains subdued, with crop prices under pressure and chemical prices also generally soft. We continue to expect sluggish performances in general for another quarter or two."

Data from the US, a big market for Indian exports, indicated "continued softness in pricing", while capacity in China continues to be an overhang. Producer prices in the US is down 4.9 percent YoY and import prices have fallen 0.2 percent MoM and 18.1 percent YoY.

While chemical prices remain soft, there are five points worth highlighting, wrote the analysts.

- Prices of BOPP film increased by 10% MoM potentially a positive sign for SRF’s Packaging Films Business, although raw material polypropylene prices have also risen in recent months.

- HFC refrigerant prices have perked up in China year-to-date (YTD).

- There may be some pricing pressure on certain contract-manufactured products, e.g., topramezone and DFPA for SRF and Solstice 1233zd for NFIL.

- Astec has started shipments of pyroxasulfone — a sign of looming competition for PI and its customer Kumiai.

- Market reports suggest there might be a shortage of nitric acid (a key raw material for Deepak Nitrite and Aarti Industries) amid a plant shutdown by a key producer. Soda ash prices remain under pressure, as do phenol spreads.